C&M E-Alert: MCA Expands Fast-Track Mergers

- Shafaq Uraizee Sapre

- Sep 12, 2025

- 3 min read

WHAT IS THE AMENDMENT? |

The Ministry of Corporate Affairs (MCA) has notified the Companies (Compromises, Arrangements, and Amalgamations) Amendment Rules, 2025 (G.S.R. 603(E) dated 4 September 2025) (2025 Amendment). The changes mark a significant expansion of the fast-track merger regime under Section 233 of the Companies Act, 2013 (Act), both in scope and procedure.

WHAT HAS CHANGED? |

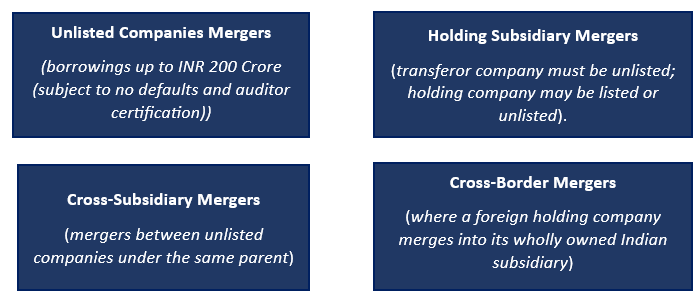

Broader Eligibility: The 2025 Amendment expands the scope of fast track mergers by bringing new categories of companies that would be eligible to take advantage of the scope of Section 233 of the Act.

Expanded Regulatory Interface: The 2025 Amendment imposes additional notification requirements on companies regulated by sectoral authorities.

Sector Regulators | Additional Requirements |

Reserve Bank of India (RBI) | Listed companies are required to notify their respective stock exchanges. Further, a statement addressing the regulator’s objections or suggestions must be annexed to the scheme filing. |

Securities Board Exchange Board of India (SEBI) | |

Insurance Regulatory and Development Authority of India (IRDAI) | |

Pension Fund Regulatory and Development Authority of India (PFRDA) |

Procedural Streamlining: The 2025 Amendment has standardised forms and prescribed clear timelines for scheme filing.

Revised forms | Timelines clarified |

Forms CAA-9 to Form CAA-12 have revised templates for solvency declarations, auditor certification, and stakeholder approvals

Revised Form CAA-10 requires stricter, evidence-backed solvency declarations than the previous version.

A new Form CAA-10A has been introduced by 2025 Amendment for unlisted company mergers, requiring the auditor’s certification of compliance with prescribed debt threshold requirements. | Schemes to be filed within 15 days of shareholder/creditor approvals

Objections permitted within 30 days.

|

WHY THIS AMENDMENT MATTERS? |

Expansion of Fast-Track Route to Demergers and Divisions: The fast-track approval process under the Act has now been extended to cover schemes for division, transfer of undertaking, and demerger, allowing eligible companies to use an administrative route instead of approaching the NCLT. With the 2025 Amendment, such reorganisations can be completed more efficiently for specified classes of companies, while retaining key scheme safeguards under section 232(3) of the Act. This amendment would sharply reduce timelines and compliance hurdles for internal corporate restructurings of the eligible companies. The revised Form CAA-10, to be filed at the stage of seeking member and creditor approval in a demerger and transfer of divisions, now requires a notarised solvency declaration with audited assets and liabilities and an auditor’s report, and thus has a stricter disclosure threshold than the declarations that were submitted in the past.

1. Greater reach: Until now, the fast-track route under Section 233of the Act was effectively a small company/ startup tool, used sparingly for limited restructurings. By expanding eligibility, the 2025 Amendment now opens the door for mid-market corporates, family-owned groups, and cross-border structures to use this simplified process. This means groups can consolidate layers, clean up subsidiaries, or hive off divisions without a full-blown tribunal process.

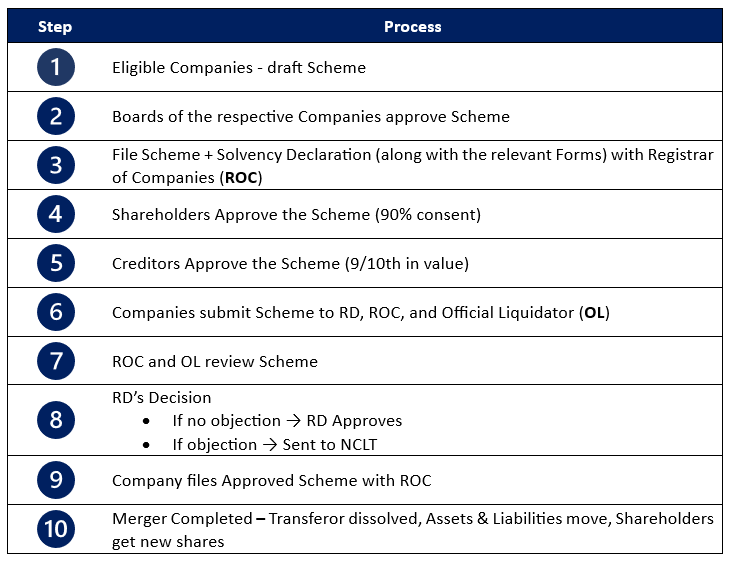

2. Efficiency: The tribunal is currently overloaded with insolvency and litigation matters, and merger approvals often take 12 to 18 months even in straightforward cases. Fast track merger schemes, by contrast, are administratively confirmed by the Regional Director (RD) rather than the tribunal. This shift has the potential to cut deal timelines down to a few months, which is critical where groups want to align corporate structures with business realities (for example: pre-IPO cleanups, funding-driven reorganisations). Practically, this translates to lower transaction costs and faster execution certainty, which investors and promoters both value.

3. Global alignment: Most developed jurisdictions (e.g., European Union, Singapore) already provide simplified procedures for intra-group reorganisations and cross-border mergers. By bringing in cross subsidiary and foreign parent Indian wholly owned subsidiary mergers into the fold, India signals a move towards modernising its corporate restructuring.

HOW A FAST-TRACK MERGER HAPPENS? |

CONCLUSION |

The 2025 Amendment significantly broadens the utility of Section 233 of the Act by extending it beyond small company mergers to mid-market, group, and even inbound cross-border reorganisations. The 2025 Amendment also introduces demergers and transfers of undertakings into the fast-track regime for eligible companies, thereby facilitating transactions and making reorganisations easier. While this is a welcome step towards modernising India’s restructuring framework and easing NCLT bottlenecks, the real-world impact will depend on how seamlessly the new processes work in practice, and whether sectoral regulators adopt a facilitative approach. It is pertinent to note that there has been a steady wave of regulatory changes over the past decade to push India’s position in the global ease of doing business rankings and to make India a business-friendly jurisdiction. The 2025 Amendments surely amplify this intent and is a welcome move for both the industry and for practitioners alike as it would reduce both time and costs in processing restructuring transactions.

For specific guidance on how these changes affect your business, please contact our team:

Comments